This is a re-publishing of a year-old post. I've grown weary, after 8 years, of butting heads with the tight oil industry and its cheerleaders about long term sustainability, upcoming location scarcity and tight oil and tight gas LNG exports. The shale industry has done a masterful job of conning the American public, and its political representatives, into believing in abundance, energy independence and 200 years of supply. That all makes people feel good; end of debate. I've terminated my relationships with three different data-sell services; I have no more charts to show anybody.

What's different today about this post a year later? Nothing, save there have been 8,000 more tight oil wells drilled in America and yet oil prices are 2 times higher than they were a year ago, natural gas prices 3 times higher. Production is up, everywhere, only because of the shear number of wells being drilled and DUCs that were completed, 2020-2021. Does tight oil development add meaningful reserves to America's long term future? Nah. Those wells produce 75%-80% of their EUR in the first 48 months of life.

I still have sources of data, including engineers working the Eagle Ford and Permian and I believe well quality is still declining, there is more vertical and horizontal well interference than ever before, the Permian is getting gassier, decline rates are accelerating... and I still stand behind the idea that the rate of increased tight oil development now, mid 2022, mostly for the sake of exports, cannot hold up another three years. By 2025 America will be in deep doo-doo, short of $150 oil prices, sustained, and even that, even more money, will not, in the long run, overcome depletion that is now occurring in America's tight oil basins.

The Eagle Ford is enjoying a re-birth of sorts, but that is limited to an small area in the thickest gross shale section in the entire play where they are drilling laterals in the lower EF. It won't last long.

I drove thru the Permian a month or so ago and there is more flaring than there was 4 years ago, because gassy oil wells are now becoming oily gas wells and there is no place to put the stuff. There were rigs, and vacuum trucks hauling produced water to disposal facilities, everywhere. NE of Van Horn, while watching a beautiful West Texas sunset, my small glass of scotch on the tailgate shook like the movie, Jurassic Park when the T-Rex was nearby.

If you don't have the patience to read this again, I understand, just look at the charts, maps and quotes. Holy Moly, I have no idea where they think they can put 150,000 more tight oil wells in the Permian.

Our country is speeding to a red light.

This is an awesome graphic, uh? It makes it look like America is full of oil and places like Texas, North Dakota, New Mexico, Oklahoma and Colorado will be the oily gift that keeps on giving.

For the sake of argument, and on behalf of the utterly "silly" notion of conserving America's oil for the future, lets look at all this in a different way:

Conventional oil production in the United States has fallen to 43% of total US production, is declining at the rate of 4% annually and its proven developed reserves are not being replaced. There has not been a significant onshore discovery of conventional reserves in our nation in 40 years.

Unconventional oil is America's last, remaining hope for long term energy security. The SCOOP/STACK, the DJ Basin, the Eagle Ford, Bakken and mighty Permian shale and shaley carbonate basins are the last refuge for our oily future.

Interestingly, those large shale basins truly only consist of a mere, dozen or so counties and those areas are amazingly small in areal extent compared to the size of the entire basin. Each of those counties are already saturated with wells, almost 100,000 to be exact, and still growing.

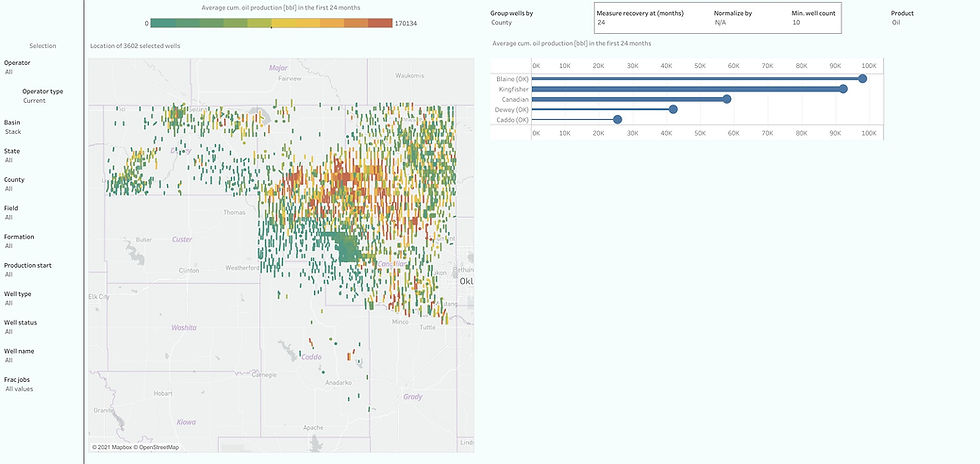

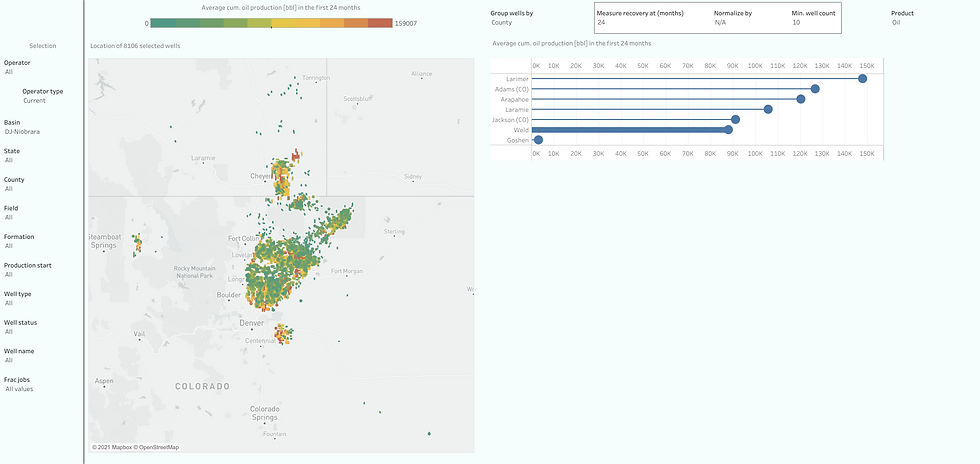

[All charts below courtesy shaleprofile.com and represent actual realized production data filed from operators to State regulatory agencies. Line thickness represents the number of wells in the basin or county. On the maps the green, yellow and red dots (lines) are all HZ wellbores. You may click to enlarge the charts.]

OKLAHOMA SCOOP/STACK

In the SCOOP/STACK tight oil play of Oklahoma, Kingfisher County is No. 1 for total production and well count and is still getting new HZ wells drilled in it. Blaine and Canadian Counties have got a bad case of gas; economics suck in both these trends. Truthfully, this SCOOP/STACK stuff is not applicable to America's long term oil future. Gas maybe, not oil.

COLORADO DJ

In the DJ Basin of Colorado, look at how small the heart of this "watermelon" is. Weld County is No. 1 on the hit parade in Colorado and new wells are getting packed into that county like sardines.

Remember, in the DJ Basin terminal decline rates for HZ wells over four years old are 22-25% per year!! The best of the best HZ wells in the DJ have 221K BO EUR's and have the life expectancy of barn yard chickens. To be honest, this basin is irrelevant in the big picture, also.

TEXAS EAGLE FORD

In the Eagle Ford play, DeWitt, Karnes and Gonzales Counties are the top producing counties and even today most of the new drilling occurs there. LaSalle, Dimmit and Webb counties are getting a lot of attention recently because they are in or near the liquids rich gas to dry gas leg of the Eagle Ford and gas prices are high. In a trend that has an average EUR of 263K BO per well, La Salle, Dimmit and Webb Counties produce EUR's of 180K BO.

In three more years I don't think you'll be able to squeeze another shale oil well into Karnes County with a shoe horn. Cattle in that county will have to learn to eat limestone pads to survive.

Eagle Ford production is currently 923K BOPD, down over 842K (!!) BOPD from its peak in 2015. Stick a fork in this unconventional play.

NORTH DAKOTA BAKKEN

In the Bakken, three counties make up the bulk of this wad of HZ tight oil wells, maybe four including Williams. In this remote part of North Dakota there are Bakken and Three Forks wells as far as a fella can see. The Bakken is the New York City of shale oil basins.

Bakken production is currently 1.1MM BOPD, down 426K BOPD from its high in 2019. Its had its day in the sun.

The four unconventional shale basins referenced above are in decline (the Bakken will be, soon) and short of a miracle of capital abundance, as in getting free checks from the federal government to drill shale wells, those basins likely will NOT reach previous production highs.

TEXAS PERMIAN

All of America's oil eggs are now in the Permian Basin basket and thankfully, everything in Texas is big.

But even in the Permian there are truly just 6-7 counties in the two sub-basins that represent the bulk of existing production and future drilling prospects. Above is a chart of the historical ranking of total HZ drilling permits by county in the Permian Basin, thru 5.2021. The old adage, the best place to find new oil is in old places is particularly true for the shale biz. They'll keep "high grading" until they can't anymore because they know what awaits them on the flanks...higher costs, less production and even worse well economics.

You decide for yourself how profitable this shaley carbonate play has been in the Permian Basin the past 7 years (its still $165-170B in public and private debt) and where the capital is going to come from to keep playing pixie sticks with HZ laterals in West Texas.

It seems to me this dance floor is already getting crowded. You can't two-step anywhere without bumping into somebody else.

Personally, I think the Permian is going to blowup some day, like a big giant balloon, from all the produced water being stuffed into it.

Seven Counties in the vast Permian Basin are responsible for the bulk of its total production.

Its so crowded in Midland County of the Midland Basin, the home of Qatar America for Pioneer Resources, GOR is rising steadily and liquids productivity is going down.

Even the ever vigilant EIA seems to believe that Permian oil production "efficiency," whatever the hell that means, is starting to decline.

After just seven years. Does that sound like long term sustainability to you, that we can tell OPEC and the rest of the world to take a hike, we've got all the grease we can EVER use?

Is it really a big wide, oily America we live in, with tens of thousands of more shale oil locations to drill?

No, it is not.

What's left of our nation's oil resources lies in a handful of sweet spots in a few individual counties in two states, and those counties are already jam packed with horizontal wells,

There is now more sand in the mighty Wolfcamp formation than there is on all of South Padre Island.

We are lied to every day about remaining locations to be drilled and remaining reserve potential from vast unconventional shale resources, resources that are expensive to extract and marginally profitable, at best.

There are currently 31,500 horizontal, unconventional wells producing in the Permian Basin right now and 53% of all the rigs running in America are horizontal land land rigs working in West Texas. What was the hot topic in Midland last week? How to stuff MORE wells in sweet spots where costs are "three times lower" than out in goat pasture.

How long can the Permian Basin "develop only sweet spots, likes it been doing the past seven years?"

The answer is, not very much longer.

In the mean time, exporting 70% of Permian/Eagle Ford HZ tight oil production to Asia, below costs, will one day prove to be the biggest energy policy blunder in history. A half million barrels of HZ tight oil was exported to China in 2020; this morning we're learning that China may actually be funding the Taliban in Afghanistan. Hot diggity dog!

For some perspective on the areal extent of America's remaining resource potential, this is a Sky Truth Gas Flaring satellite map. We clearly can see the Bakken, Permian and Eagle Ford shale oil basins and how small they are compared to much larger productive basins in North Africa, the Middle East and Russia.

Come on in boys, the water is fine!

TRRC GIS Map, Karnes County

Comments